This is an attempt to provide a

brief outline of the features and benefits of a Tax Qualified Long Term Care Insurance

policy. Descriptions of Choices Options and Features will be discussed at

another time.

Choices:

When you decide to purchase LTCi your first choice is what

type of policy: Reimbursement, Indemnity or Cash benefit? Secondly the daily amount: $50-$400 a

day. Then in order to determine the

TOTAL amount available in your policy you have a choice of 365 days 1Year (CA

Partnership Only) 730 days 2 Year, 1,095 days 3 Year, 1460 Days 4 Year

etc. Some companies may still offer Unlimited

(Life Time).

Example: (Reimbursement-No inflation protection)

$200 of Daily

benefit x 1,095 day = $219,000 of Total benefit.

A.

Maximum amount available is no more $200

B.

Total Benefit to be received is $219,000 (LTCi Account

Value)

C.

One purchases is dollars not time. IF one chooses to be reimbursed $100 a

day for services received the benefit will last twice as long (6 Years)

Other benefits possibly included in a basic policy:

Equipment and Home Modification, Caregiver Training, Respite Care, Bed Reservation,

Care Management, Medical Alert, Ambulance service

Options

When considering the purchase of Long-Term Care Insurance

there are many options that one needs to consider. Options increase the cost of the policy. Some options, like Automatic Inflation are recommended in order to keep pace with the

cost of care. Other options such as Restoration of Benefits are unlikely to occur

and are priced accordingly.

Here is a list of options (not all) that are found in policies. Remember that definitions of these options

defer between companies.

·

50%-100% of Nursing Home Benefit for Home Care

·

70%-100% of Nursing Home Benefit For Residential

Care

·

Daily or Monthly reimbursement for Home Care

- Automatic Inflation Protection

o

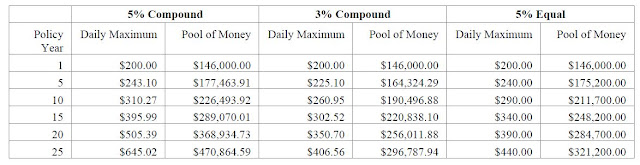

5% Compound

o

3% Compound

o

5% Simple

(Provided by Genworth)

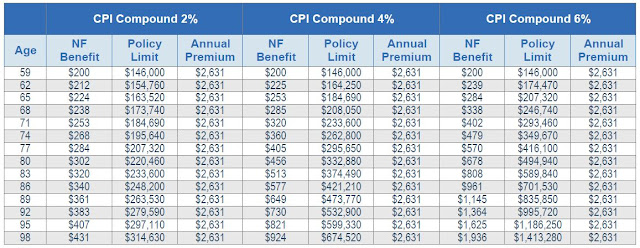

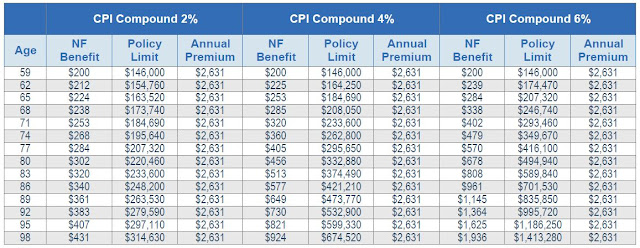

o CPI (Consumer Price Index) Inflation protection

(Provided by John Hancock Ins.)

(Provided by Genworth)

o CPI (Consumer Price Index) Inflation protection

(Provided by John Hancock Ins.)

·

Elimination Period 30, 60, 90, 180, 360 Days

o

Calendar Days or Service Days

o

Without or With: Waiver for Home Care Service

·

Shared-care Benefit

·

Survivorship and Waiver of Premium

·

Dual Waiver of Premium

·

Restoration of Benefits

Nonforfeiture

No comments:

Post a Comment