The 2013 Community Spouse Resource Allowance (CSRA) is $115,920 up from $113,640 (2012)

The maximum Minimum Monthly Maintenance Needs Allowance (MMMNA) for 2013 is $2,898 up from $2,841 (2012)

2013 (DRA 2005) Home Equity Limits: Minimum $536,000 Maximum $802,000 (CA)

CA Average Semi Private N.H. Rate 2013: $7,098

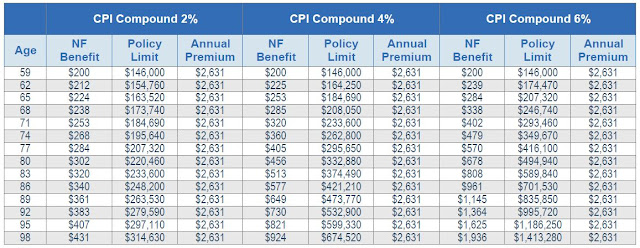

CA Partnership Minimums

CA Partnership for Long Term Care Minimum Daily Benefit for 2013 is $170 a day for Nursing Home and $119 per day (70% of N. H.) for Residential Care and Assisted Living. Minimum Monthly reimbursement for Home Care (50% of N.H.) is $85 x 30 = $2,550 and $85 x 31 = $2,635. Average Private Pay (Nursing Home) Rate has not been released. ( It will most likely to remain at $8,640)

Medicare Part B (Medical Insurance Cost)

If your yearly income in 2011 was

Individual File Joint Return You Pay

$85,000 $170,000 $104.90

$85-$107K $170-$214K $146.90

$107-$160K $214-$320K $209.80

$160-$214K $320-$428K $272.70

above $214k above $428K $335.70

Skilled Nursing Facility Stay

In 2013, you pay

- 0 for the first 20 days of each benefit period

- $148 per day for days 21-100 of each benefit period

- All cost for each day after 100 of the benefit period